Underwriting, or the process of gathering data to evaluate risk exposures and determine the cost of an insurance policy, is critical for the financial health of insurance companies. It ultimately helps them decide whether to provide insurance coverage to a business or individual. Once they agree to do so, the insurer will be accepting financial responsibility for the types of loss covered in that policy.

Since there is a chance for financial loss, insurance companies spend a great deal of time assessing risk and determining whether they can afford to take on the exposure a potential policyholder brings. That means in property and casualty insurance, the underwriting process often involves saying “no.”

So how can we say “yes” across a broad range of specialty insurance products while maintaining a strong financial position for all of our policyholders? The answer lies in our granular, data-based approach to underwriting.

The History of Underwriting

The concept of underwriting dates back to the 17th century when ship owners and merchants would visit London coffeehouses in search of investors who were willing to offer financial support for their shipping operations. They would share important details about their upcoming voyages with potential investors, and field questions about how risky the trip might be, such as: “How old is the ship?” “How experienced is the captain and crew?” “What route are you taking?” “Has the captain been there before?” When the exchange of information was completed and the investors felt comfortable with an agreed price, they would “write” their name “under” all the details on the shipping manifest.

Underwriting has centuries-old roots and is still a fundamental practice of an insurance company today. Although the practice has evolved significantly, underwriting still involves asking a lot of questions—and, for the underwriting department at Palomar, using more detailed, granular data than other major insurers to make our pricing and coverage decisions.

Getting Specific

Since our company’s inception, we’ve embraced the power of specificity by investing heavily in data analytics. We know that no two buildings are alike, even if they’re on the same street. Some are older, some are more updated, some are on higher ground, some are built with concrete and some are built with wood. We believe that anyone who has taken steps to mitigate potential damage from natural disasters to their property, such as installing storm windows, repairing pipes, and building according to state earthquake safety standards should be rewarded with our best policy options.

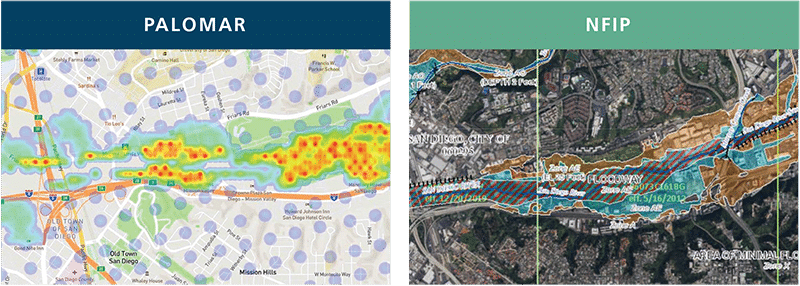

That’s why we’ve adopted the best technology to help us assess risk on an individual, lot-by-lot, or address-by-address basis, rather than the broad geographic zones used by other major insurers, as well as national programs like the National Flood Insurance Program (NFIP).

This also allows us to price competitively, because our geographic zones are smaller—for example, if you live somewhere with lower flood risk in California, you are not going to pay a higher premium to subsidize damages to a policyholder’s home in hurricane-prone Louisiana.

The More You Know

Like many insurers, our business is sustainable because we “write what we know” when it comes to policies. However, our proprietary granular data modeling tools use extensive geographic and actuarial data to greatly expand “what we know” about a given property’s level of risk. Many of our competitors, while they are beginning to embrace this approach, are using less granular analytics and more manual underwriting processes, and are therefore unable to price policies with the same degree of specificity. The proprietary operating platform used by Palomar was created with input from our management team, who have extensive underwriting experience, but it is not burdened by the outdated legacy technology and processes used by older companies.

Gathering so much information for granular underwriting has also allowed us to expand into new markets that may have previously been overlooked, though there is still plenty of risks involved. For example, we provide affordable flood coverage in inland states like Colorado and Tennessee, which have plenty of rainfall, lakes, rivers, and another potential for flooding and water damage, even if they’re not coastal.

Palomar embraces best-in-class technology to learn all we can about every policyholder’s property and risk, so we can give them a highly customized, tailored policy with an affordable premium. We can’t change the fact that a lot of underwriting involves saying “no”—but we’re proud to say that we have the tools to help us say “yes” in ways that benefit our partners and customers.

Learn more about Palomar products and coverage here: https://plmr.com/products-coverages/